The race for an XRP exchange-traded fund (ETF) in the United States is heating up, with Franklin Templeton becoming the latest asset manager to enter the competition. The firm recently submitted a filing for a spot XRP ETF, joining several other financial institutions eager to launch similar products.

Franklin Templeton’s XRP ETF Filing

Franklin Templeton’s proposed XRP ETF aims to mirror the price performance of XRP, with its holdings secured by Coinbase Custody Trust, according to an official filing with the U.S. Securities and Exchange Commission (SEC) on March 11.

That same day, the SEC deferred its decision on multiple crypto ETF applications, including Grayscale’s request to convert its XRP Trust into an ETF.

Despite the increasing interest in XRP ETFs, BlackRock — the issuer of the largest spot Bitcoin ETF — has yet to submit an application for an XRP-based product.

Companies That Have Filed for an XRP ETF in the U.S.

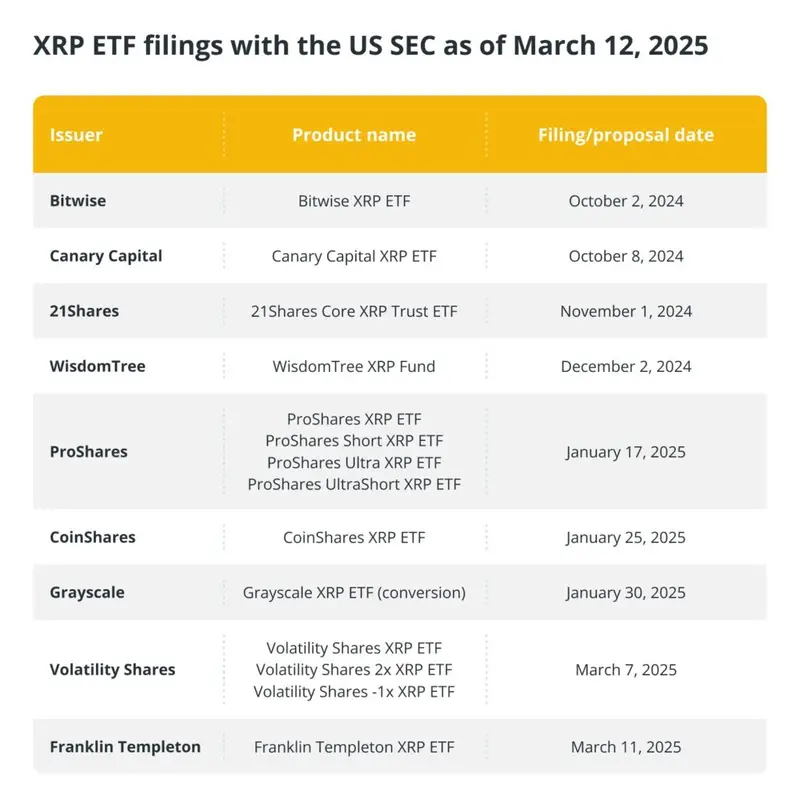

As of March 12, nine firms have submitted filings for XRP ETFs, including major industry players such as Bitwise, ProShares, and 21Shares.

Bitwise, a leading crypto fund manager, was the first to file a Form S-1 application for an XRP ETF on October 2, 2024.

Following Bitwise, Canary Capital entered the fray by filing a Form S-1 for a similar product on October 8, 2024.

Switzerland-based 21Shares and U.S. ETF provider WisdomTree also joined the competition, submitting their filings in November and December 2024, respectively.

ProShares expanded the XRP ETF landscape in 2025 by submitting applications for multiple XRP-based funds, including the ProShares XRP ETF and three additional XRP investment products, on January 17.

CoinShares, a European crypto investment firm, entered the market with its own XRP ETF application in January, while Grayscale submitted a proposal on January 30 to convert its XRP Trust into an ETF for trading on the New York Stock Exchange.

Volatility Shares, a Florida-based financial services company established in 2019, added to the growing list of applications on March 7, introducing three separate XRP ETF products: the Volatility Shares XRP ETF, the Volatility Shares 2x XRP ETF, and the Volatility Shares -1x XRP ETF.

Additional ETF Filings Including XRP

Beyond standalone XRP ETF filings, at least two asset managers have included XRP as part of broader crypto-focused ETFs.

On January 21, asset manager REX-Osprey submitted a filing for an “ETF Opportunities Trust,” which features seven ETFs tracking various assets, including XRP, Bitcoin, and even memecoins like Bonk and Official Trump (TRUMP).

Similarly, Tuttle Capital Management filed for an ETF opportunities trust, which includes 10 daily target ETFs covering assets such as XRP and Melania (MELANIA).

Firms Yet to File for an XRP ETF

While several firms have jumped on the XRP ETF bandwagon, some major players remain on the sidelines. Notably, BlackRock has yet to file, and other prominent firms such as Invesco, VanEck, ARK Invest, Fidelity Investments, and Galaxy Digital have not yet submitted applications for XRP ETFs.

As the demand for crypto ETFs continues to rise, it remains to be seen which firms will take the next steps in securing regulatory approval for an XRP-based product.

For more news, find me on Twitter Giannis Andreou and subscribe to My channels Youtube and Rumble

What is your opinion on this particular topic? Leave us your comment below! We are always interested in your opinion!