Michael Saylor has set out to reinvent how corporations think about their balance sheets.

Since August 2020, his company — originally MicroStrategy, now rebranded simply as Strategy — has pursued one of the most aggressive Bitcoin accumulation campaigns in history.

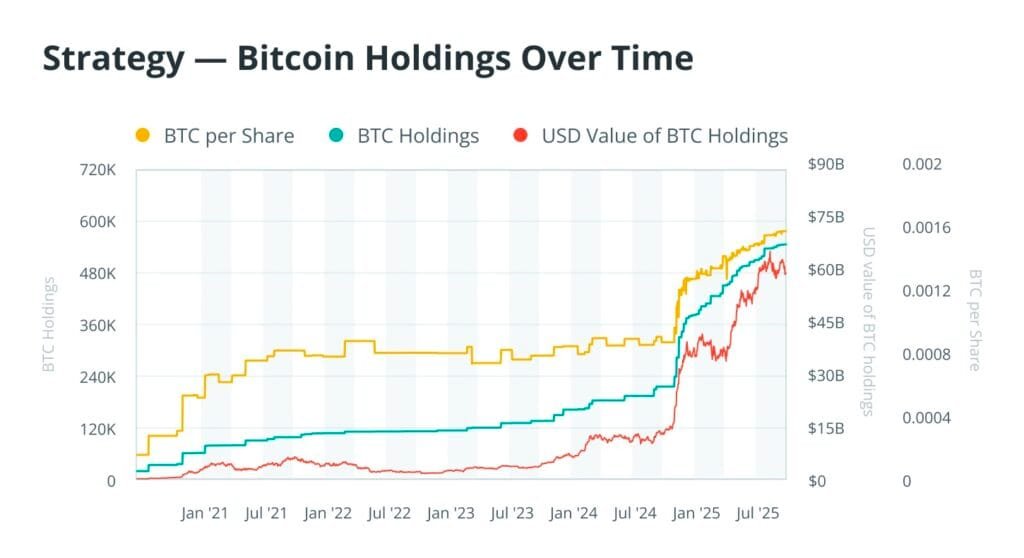

By September 2025, the firm had built a position of 640,031 BTC, worth over $73 billion at current prices. With an average entry cost in the tens of thousands, Strategy now sits on billions in unrealized gains.

For Saylor, Bitcoin is more than just an investment. It’s an antidote to inflation, a store of value immune to political manipulation, and a bet on the next wave of institutional capital he believes will pour in. His argument is simple: if Wall Street allocates even 10% of its assets to Bitcoin, the price could eventually break $1 million.

Why Bitcoin is the “perfect” treasury reserve

Saylor’s approach has been remarkably consistent: buy Bitcoin, never sell, and weave it directly into the corporate structure.

Since 2020, Strategy has funneled cash flow, debt issuance, and equity sales into a steady pipeline of BTC purchases. Today, its 640,031 BTC represents roughly 3% of the total supply, with an average acquisition cost of about $73,983.

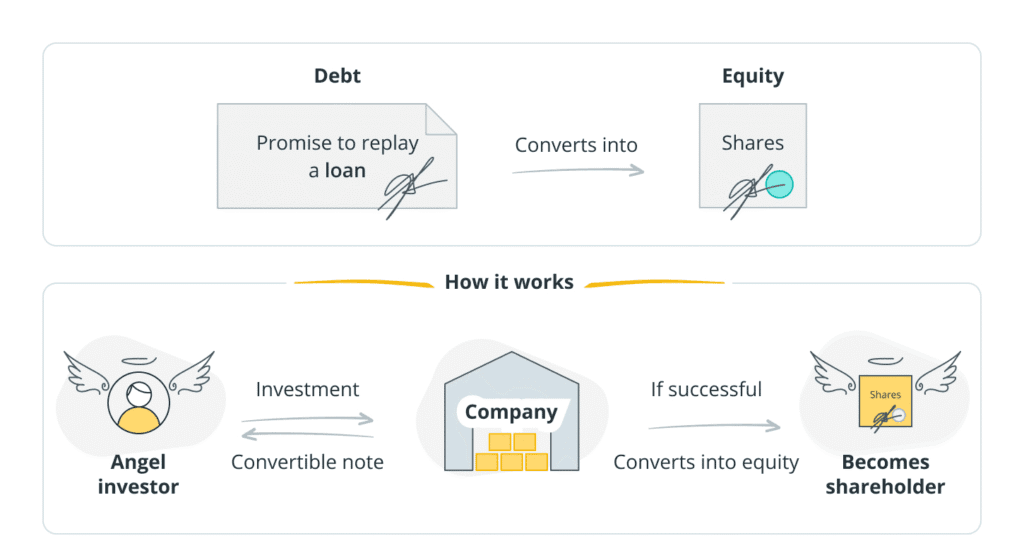

To finance this war chest, the company has leaned on an arsenal of tools: zero-coupon convertible notes, at-the-market equity offerings, and preferred stock — all designed to raise funds without crippling shareholder value.

Saylor treats volatility not as a danger but as opportunity. Dips are chances to accumulate more, while long-term scarcity is the tailwind.

His philosophy rests on Bitcoin’s fundamentals:

- Fixed supply: capped at 21 million coins, reinforced by halving cycles.

- Digital superiority over gold: portable, borderless, and secure.

- Hedge potential: increasingly uncorrelated with equities and bonds, offering protection in inflationary or easing-heavy environments.

For these reasons, he calls Bitcoin the most efficient treasury asset for the 21st century — scarce, transportable, durable, and positioned for the future.

The $1 million thesis

Saylor’s most controversial projection? Bitcoin at $1,000,000 per coin.

His math starts with the sheer size of institutional capital. Pension funds, insurance firms, mutual funds, and asset managers control more than $100 trillion. Even a 10% allocation — around $10-$12 trillion — could send BTC soaring.

Divided across the full 21 million supply, that would imply around $475,000 per coin.

But the real supply is far tighter. Millions of coins are lost forever, long-dormant wallets and corporate treasuries remove another chunk, and over 70% of the circulating BTC is now deemed illiquid. Adjusting for that, the same $10-$12 trillion could drive the price into the $555,000-$750,000 range.

Factor in future growth of institutional assets or allocations greater than 10%, and Saylor argues the million-dollar level becomes realistic — though not immediate. Regulatory frameworks, risk committees, and liquidity constraints will slow the process.

Funding the Bitcoin empire

Strategy’s playbook relies on creative financing, with convertible debt at the core.

- Convertible senior notes: Low- or zero-interest notes that can convert into equity later, minimizing cash burn. In mid-2024, an $800 million issuance funded 11,931 BTC at about $65,883 each. A similar $600 million deal followed soon after.

- Preferred stock offerings: Higher-yield instruments marketed explicitly for Bitcoin buys. In July 2025, Strategy expanded its “Stretch” preferred stock program from $500 million to $2 billion, with yields as high as 11.75% — a sign of strong investor demand.

- Recent purchases: As of September 2025, the company added 196 BTC for $22 million at an average of $113,048, using proceeds from equity and preferred issuances.

Risks, criticisms, and the road ahead

Strategy now resembles a leveraged Bitcoin fund, with its share price tied closely to BTC movements. Heavy reliance on debt and equity raises creates dilution risks for shareholders.

Analysts also highlight:

- Regulatory uncertainty: Changes in tax or accounting standards could hit the model.

- Concentration risk: Billions tied to one volatile asset.

- Institutional hesitation: The $1M case depends on Wall Street actually committing capital.

Still, the firm has normalized Bitcoin as a corporate reserve, accelerated ETF and custody development, and brought digital assets further into mainstream finance.

What to watch going forward:

- New fundraising structures from Strategy

- Regulatory clarity on accounting for Bitcoin

- Signs of large institutional capital flowing into BTC

If Saylor’s vision proves right, his strategy won’t just reshape his company — it could redefine how corporations and institutions manage wealth in a Bitcoin-driven era.

Download the FREE Bitcoin Mining eBook

Kickstart your mining journey with essential insights:

https://bitmernmining.com/landing-page-ebook-download/

For more news, find me on Twitter Giannis Andreou and subscribe to My channels Youtube and Rumble

What is your opinion on this particular topic? Leave us your comment below! We are always intere