The United States has surged into second place worldwide for cryptocurrency adoption, helped by regulatory advances in Washington and strong demand for exchange-traded funds (ETFs), according to Chainalysis’ latest Global Adoption Index.

India retained the number one position for the third consecutive year, pushing the broader Asia-Pacific region into the spotlight as the fastest-growing market between July 2024 and June 2025.

Kim Grauer, chief economist at Chainalysis, explained that adoption is accelerating both in developed economies with clearer regulations and institutional frameworks, and in emerging markets where stablecoins are reshaping the way people save and transfer money.

“The key driver here is utility—whether it’s using stablecoins for remittances, protecting savings from inflation, or leveraging decentralized apps that meet local needs, people embrace crypto when it directly improves their financial lives,” Grauer said.

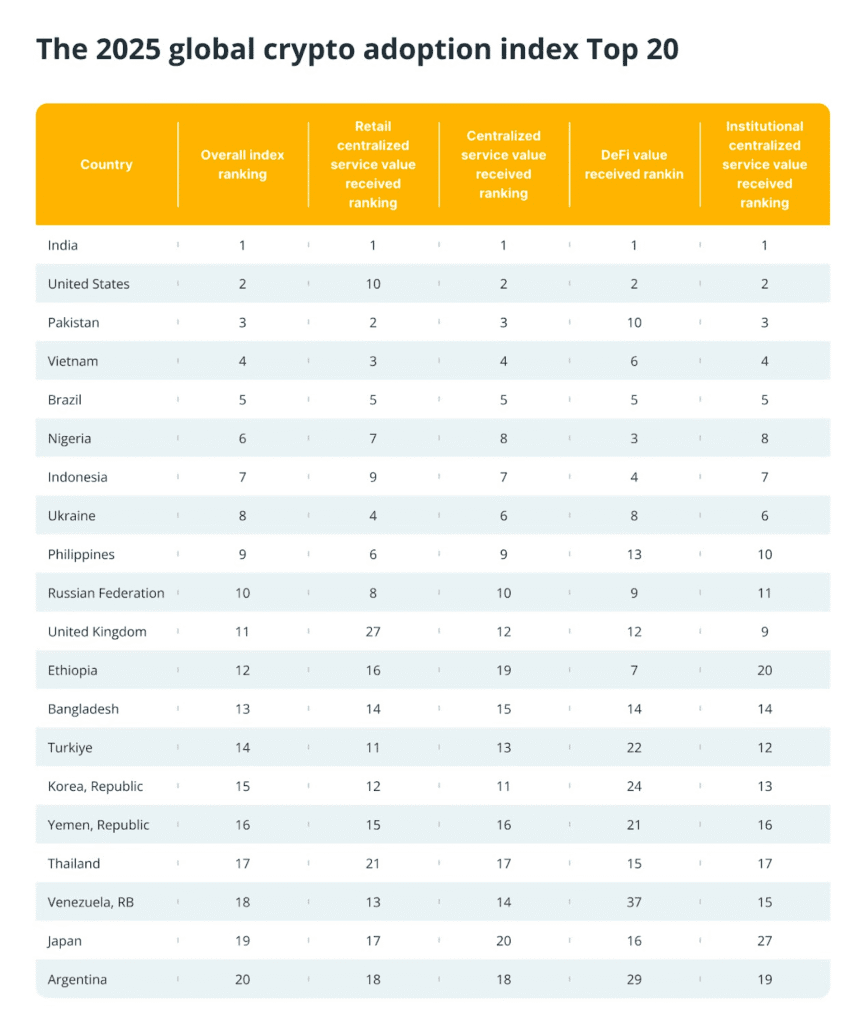

Pakistan jumped six places to rank third, with Vietnam and Brazil completing the top five. Nigeria, which previously held second place, slipped to sixth despite modest regulatory gains. Rounding out the top 10 were Indonesia, Ukraine, the Philippines, and Russia.

The rankings are based on four subindexes measuring both retail and institutional flows across centralized and decentralized services.

US boost from ETFs and clearer regulations

The US rose from fourth to second place, largely due to the rise of spot Bitcoin ETFs and a regulatory framework that has helped integrate crypto into mainstream finance.

Grauer noted that “regulatory certainty is crucial for big corporations and traditional institutions, where compliance and reputational issues carry significant weight.”

Since their launch in January 2024, US spot Bitcoin ETFs have attracted $54.5 billion in inflows, with most of the activity taking place between June and July, according to Farside Investors. Meanwhile, investment managers and hedge funds have piled into spot Ether ETFs, accumulating more than $2 billion in the second quarter alone.

India’s dominance fuels Asia-Pacific momentum

India ranked first across all four Chainalysis subindexes, supported by a tech-savvy population and strong remittance activity from its global diaspora.

Grauer highlighted that grassroots adoption thrives in places with pressing financial needs, regardless of whether regulations are favorable.

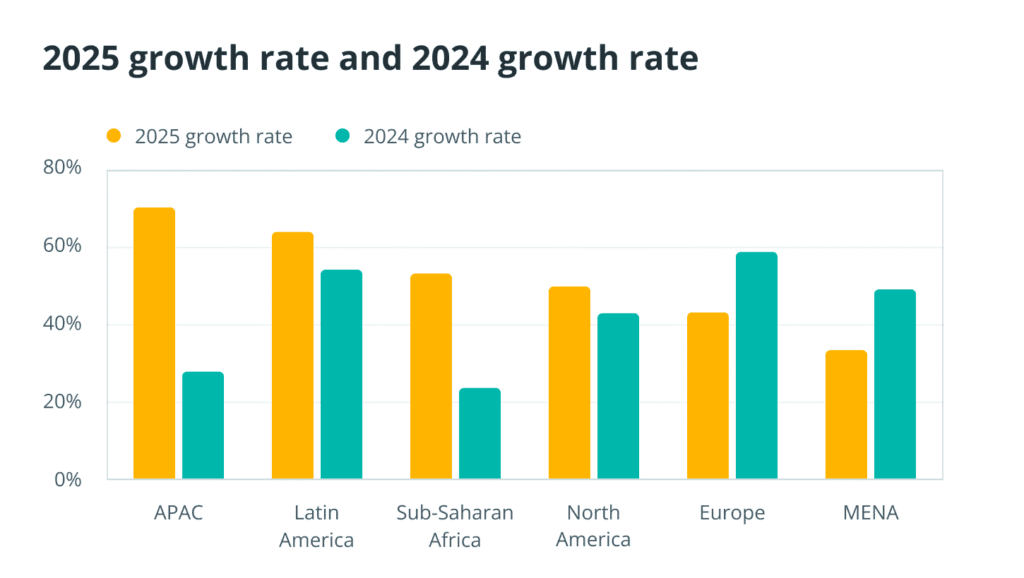

Overall, Asia-Pacific posted a 69% year-on-year increase, with $2.36 trillion in value received. Besides India and Pakistan, Vietnam, the Philippines, South Korea, and Thailand also appeared in the top 20.

Latin America also showed strong progress, growing 10% over the year. Brazil and Argentina both made it into the global top 20, reinforcing the region’s position as another rising hub.

Eastern Europe leads per-capita adoption

Looking at adoption relative to population size tells a different story. Eastern Europe dominates the per-capita rankings, with Ukraine, Moldova, and Georgia claiming the top three spots.

Other high-ranking countries included Latvia, Montenegro, Slovenia, Estonia, and Belarus. Chainalysis attributed the region’s lead to factors such as economic instability, limited trust in traditional banks, and widespread technical literacy.

“These conditions make crypto attractive for wealth protection and cross-border transactions, especially where inflation, conflict, or financial restrictions are present,” the report noted.

Bitcoin remains the entry point

Bitcoin still dominates global adoption, with over $4.6 trillion in fiat inflows during the period studied. Layer-1 tokens beyond Bitcoin and Ether collectively exceeded $4 trillion, while stablecoins captured just under $1 trillion. Memecoins accounted for about $250 billion.

The US led the way with $4.2 trillion in crypto on-ramp volume, followed by South Korea at $1 trillion. Bitcoin proved especially popular in the UK and European Union, where it made up nearly half of all fiat-to-crypto purchases.

Download the FREE Bitcoin Mining eBook

Kickstart your mining journey with essential insights:

https://bitmernmining.com/landing-page-ebook-download/

For more news, find me on Twitter Giannis Andreou and subscribe to My channels Youtube and Rumble

What is your opinion on this particular topic? Leave us your comment below! We are always intere