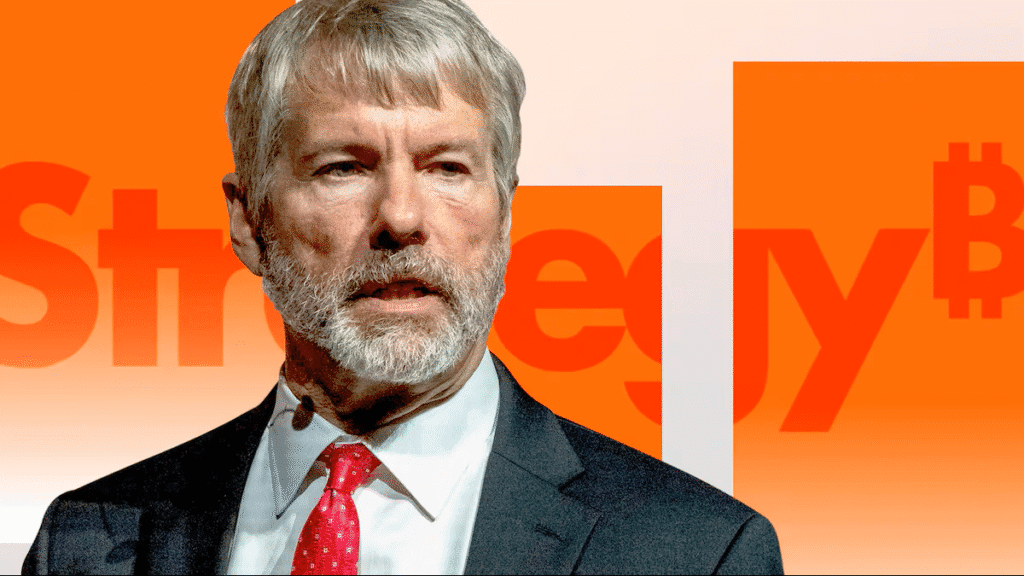

Michael Saylor’s company, Strategy — known as the largest publicly traded holder of Bitcoin — increased its stack once again, taking advantage of last week’s market pullback.

According to a filing with the U.S. Securities and Exchange Commission, Strategy purchased 3,081 BTC between Monday and Sunday, spending roughly $356.9 million. The coins were acquired at an average cost of $115,829 per Bitcoin, with prices ranging from around $116,700 earlier in the week down to a low near $112,000, data from CoinGecko shows.

This latest purchase brings the firm’s total Bitcoin reserves to 632,457 BTC, accumulated at an overall cost of about $46.5 billion. The average entry price across all holdings now stands at $73,527 per coin.

August Accumulation Slows Down

The buy comes on the back of two smaller transactions earlier this month: one for 430 BTC and another for 155 BTC. With the most recent addition, Strategy has picked up 3,666 BTC in August — far less than the 31,466 BTC acquired in July and the 17,075 BTC added in June.

Despite the slower pace, Strategy continues to reinforce its commitment to Bitcoin, steadily increasing its exposure regardless of short-term price swings.

Download the FREE Bitcoin Mining eBook

Kickstart your mining journey with essential insights:

https://bitmernmining.com/landing-page-ebook-download/

For more news, find me on Twitter Giannis Andreou and subscribe to My channels Youtube and Rumble

What is your opinion on this particular topic? Leave us your comment below! We are always intere