Once seen as experimental tools, stablecoins have rapidly evolved into critical infrastructure for global payments. This transformation is largely driven by faster settlement times, clearer regulations, and growing technical readiness, according to Fireblocks’ newly released 2025 State of Stablecoins report.

Survey Insights: Widespread Institutional Adoption

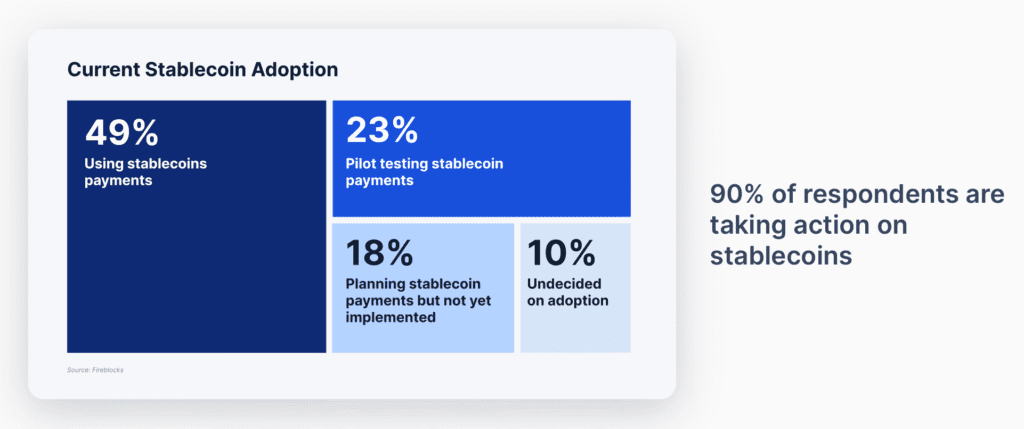

Based on a survey of 295 executives in the financial sector, Fireblocks found that 90% of firms are actively engaged in stablecoin projects. In 2024, nearly half of all transactions on the Fireblocks platform involved stablecoins. Banks and payment firms are now processing over 35 million stablecoin transactions every month, a strong signal that these digital assets have entered the financial mainstream.

Cross-border payments are the leading use case, particularly for business-to-business transfers in developing economies where traditional financial systems often fall short due to inefficiencies and high fees.

Driving Forces: Speed and Revenue, Not Just Savings

While lower costs remain a benefit, faster transaction settlement was ranked as the top advantage by 48% of respondents. Institutions aren’t just aiming for efficiency—they’re leveraging stablecoins to unlock new revenue streams, reclaim lost market share, and expand into untapped regions.

Regulatory hurdles have significantly eased as well. Only 20% of firms now cite compliance as a concern—down dramatically from 80% in 2023—thanks to more defined legal frameworks and advancements in anti-money laundering measures.

Regional Trends and Adoption Gaps

Adoption patterns vary widely by region. Latin America leads the charge, with 71% of firms using stablecoins for cross-border payments. Asia’s focus lies in unlocking new markets, while North America, although lower in current adoption at 39%, has 88% of institutions viewing upcoming regulations as a positive step. In Europe, where regulation under MiCA is more advanced, the focus has shifted toward bolstering security, with 37% seeking enhanced safeguards.

Infrastructure Readiness and Scalability

An impressive 86% of firms report being technically prepared for stablecoin implementation. However, the challenge of scaling persists, with many institutions seeking enterprise-level infrastructure to handle growing demand. Security is still a concern—36% of respondents say stronger protections are essential for broader adoption.

Real-world examples of scalability are emerging. Fireblocks pointed to its partnership with Zeebu, which facilitated $5.7 billion in stablecoin-based telecom settlements, as evidence that large-scale operations are viable.

Looking Ahead: From Optional to Essential

The report makes one thing clear: stablecoins are no longer a niche solution—they’re becoming indispensable. With rising competitive pressure and expanding use cases like instant settlement and programmable finance, institutions that invest early in compliant, secure systems are setting themselves up to lead in the next wave of digital finance.

For more news, find me on Twitter Giannis Andreou and subscribe to My channels Youtube and Rumble

What is your opinion on this particular topic? Leave us your comment below! We are always interested in your opinion!