Bitcoin’s [BTC] recent price rally has reignited discussions around market dynamics, particularly Binance’s massive stablecoin reserves and their role in fueling bullish sentiment. As of December 31, these reserves soared to an impressive $44.5 billion, signaling significant buying potential that could further propel BTC upward.

At the time of writing, Bitcoin was trading at $93,592.03, reflecting a 1.20% gain over the last 24 hours. With robust liquidity and growing momentum, the cryptocurrency market’s outlook remains optimistic.

How Stablecoins Drive Bitcoin Price Surges

Stablecoins are crucial for providing instant liquidity, often acting as a driving force behind Bitcoin price movements. Historically, a surge in stablecoin inflows to exchanges has correlated with BTC price rallies, as they boost purchasing power and demand.

For example, the December 11 rally saw heightened stablecoin activity that contributed to Bitcoin gaining 4.7% in a single day. Given the current high levels of stablecoin reserves, a similar price surge may be on the horizon, reinforcing positive market sentiment.

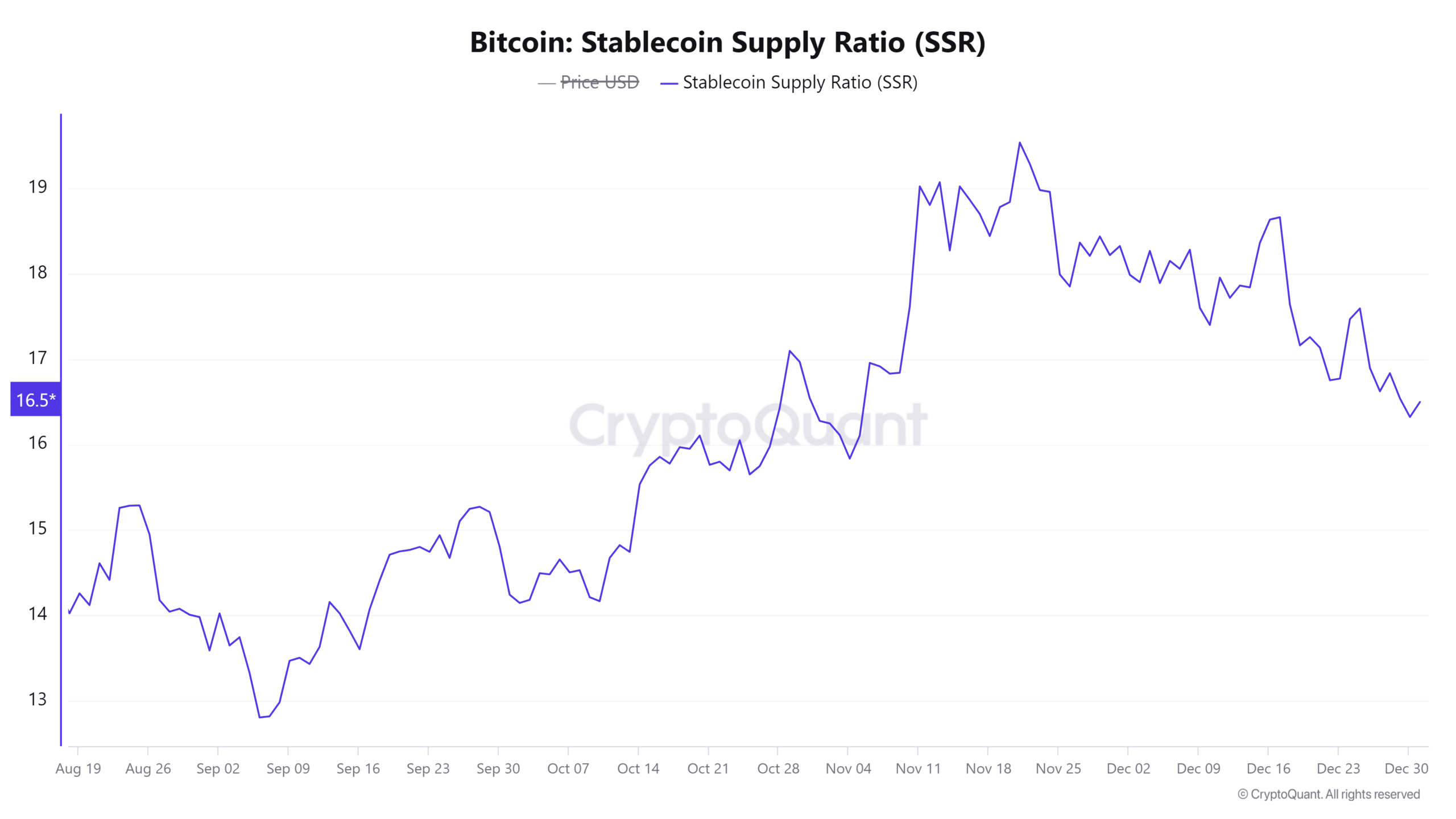

Is the SSR Signaling Further Upside?

The Stablecoin Supply Ratio (SSR), a key indicator of Bitcoin’s growth potential, currently stands at 16.55 with a 1.01% daily increase. This metric highlights the abundance of stablecoin liquidity relative to Bitcoin’s market cap, creating a favorable environment for further price appreciation.

With ample liquidity to support demand, the SSR points to a strong possibility of continued upward momentum for Bitcoin in the near future.

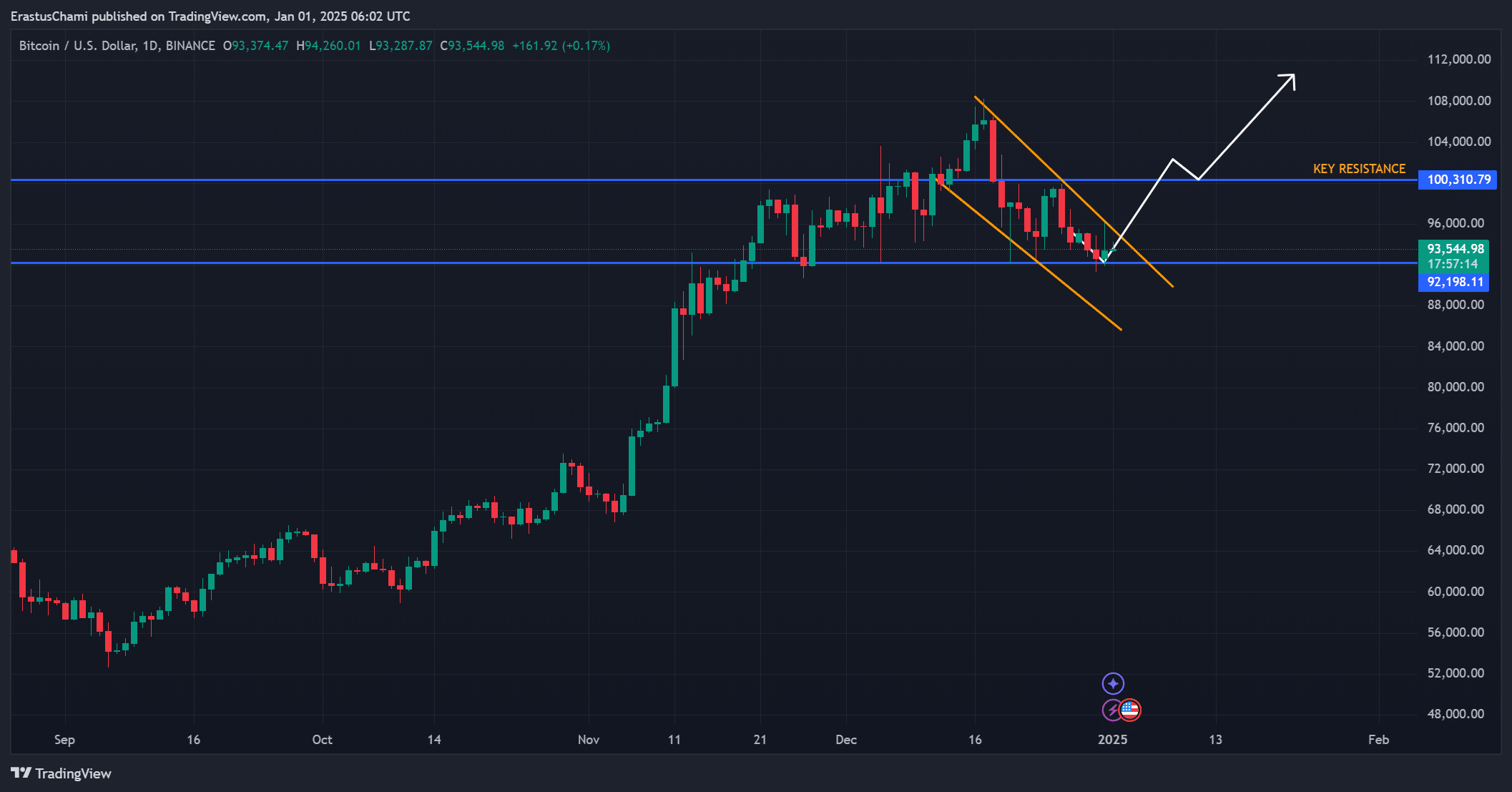

Price Action: A Breakout in the Making?

Bitcoin’s price has recently bounced back from its demand zone at $92,198.11 and is showing signs of approaching a breakout from a descending wedge pattern. Historically, such formations indicate potential bullish reversals, and Bitcoin’s movement aligns with this outlook.

Breaking through the $100,310.79 resistance level could pave the way for BTC to target $110,000 in the medium term, further solidifying its uptrend.

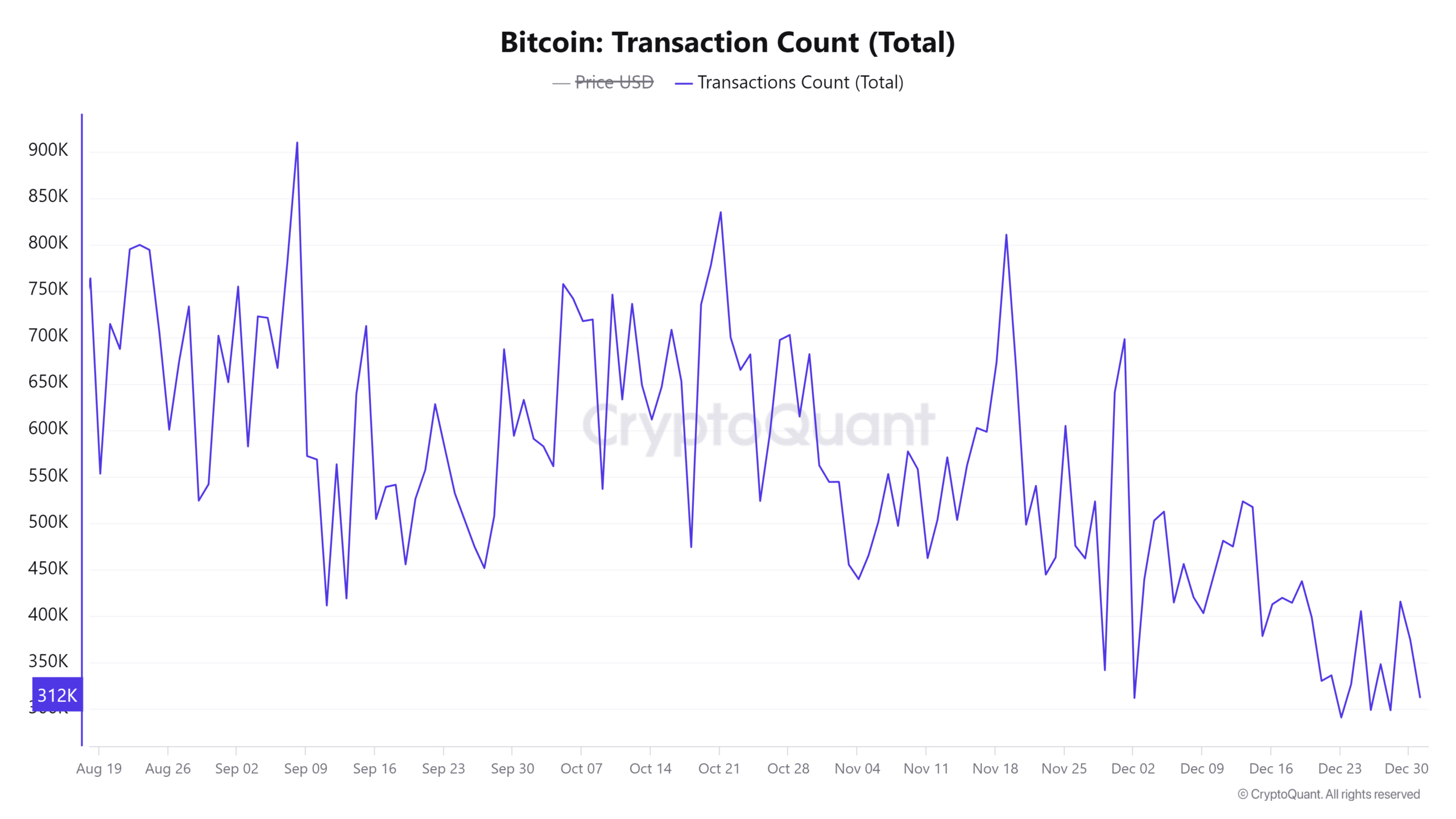

Transaction Activity Reflects Growing Confidence

The Bitcoin network has recorded 312,056 transactions in the past 24 hours, a 0.92% increase. This steady transaction volume points to heightened investor activity, often associated with accumulation phases during bullish periods.

These trends highlight increasing confidence among market participants, reinforcing a positive outlook for Bitcoin’s continued growth.

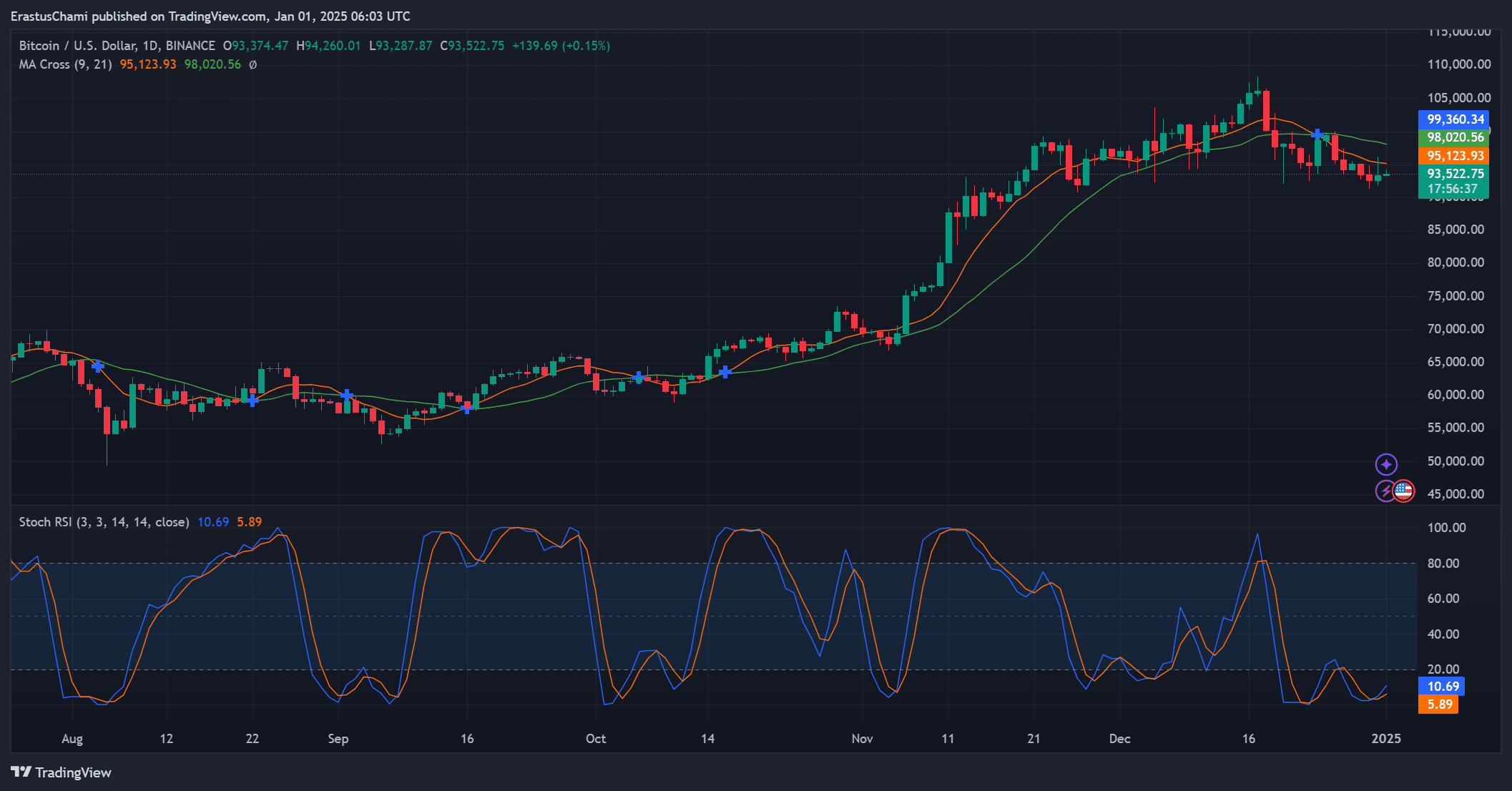

Technical Indicators Suggest Further Gains

From a technical perspective, Bitcoin’s bullish potential remains strong. The Stochastic RSI, currently at 10.69, signals oversold conditions, suggesting a likely upward reversal.

Additionally, the 9-day Moving Average (MA) at $95,123.93 remains above the 21-day MA at $98,020.56, reflecting sustained buying momentum. These factors collectively point to the continuation of Bitcoin’s rally.

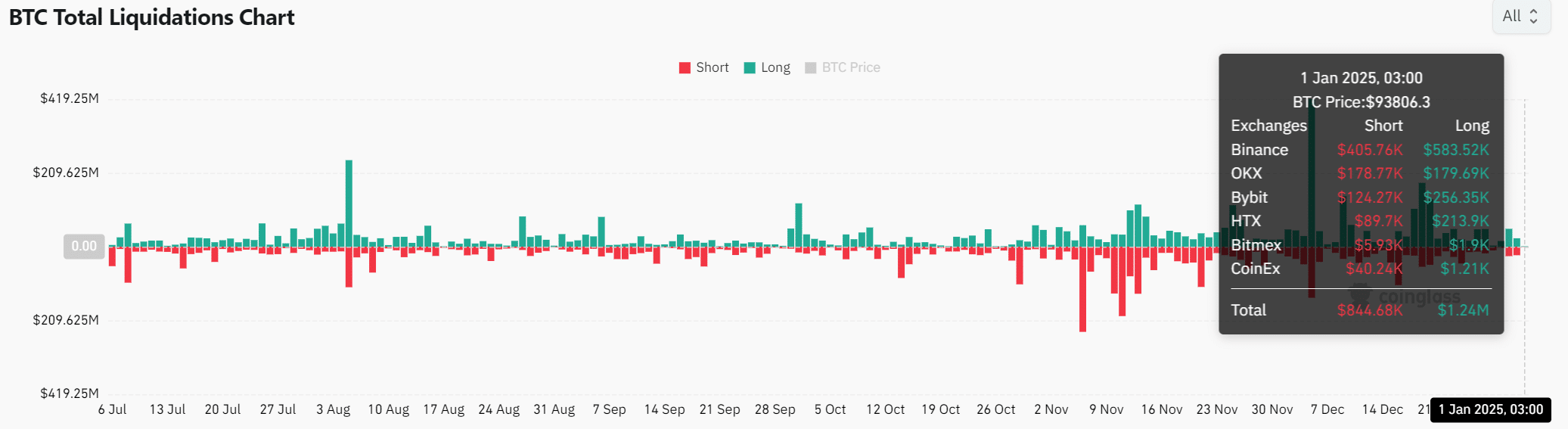

Liquidation Data Reveals Market Optimism

Recent liquidation data underscores a bullish market sentiment, with $1.24 million in long positions cleared compared to $844,000 in short liquidations.

This disparity highlights significant buying pressure, further affirming the market’s confidence in Bitcoin’s upward trajectory. It also suggests that the current bullish momentum will likely persist in the short term.

Conclusion

Binance’s $44.5 billion stablecoin reserves present a massive liquidity pool, offering strong support for Bitcoin’s ongoing rally.

When combined with robust technical and transactional trends, market participants can remain optimistic about Bitcoin potentially reaching $110,000 in the medium term.

For more news, find me on Twitter Giannis Andreou and subscribe to My channels Youtube and Rumble

What is your opinion on this particular topic? Leave us your comment below! We are always interested in your opinion!