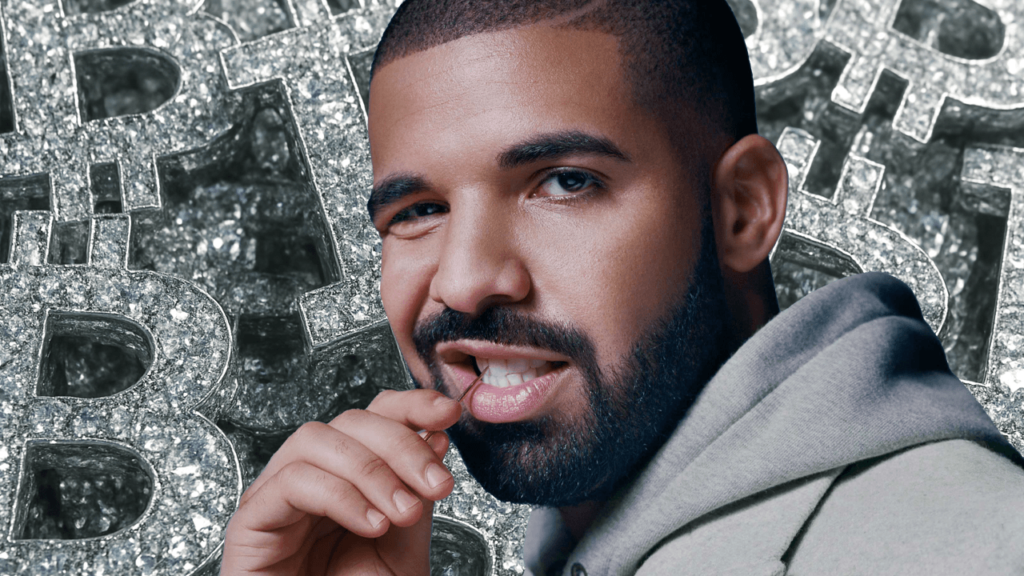

On Saturday, music superstar Drake dropped a new song titled “What Did I Miss?”, and in it, he gives a shoutout to Bitcoin — once again showing his ongoing interest in the cryptocurrency world.

This isn’t Drake’s first brush with BTC. Back in 2022, he famously bet $1 million worth of Bitcoin on the Super Bowl matchup between the Cincinnati Bengals and the Los Angeles Rams.

In the song’s opening lines, Drake compares the ups and downs of life to Bitcoin’s well-known price swings:

“I look at this shit like a BTC, could be down this week, then I’m up next week. I don’t give a fuck if you love me. I don’t give a fuck if you like me. Askin’ me ‘How did it feel?’ Can’t say it didn’t surprise me.”

Mentions of Bitcoin in popular media, from chart-topping songs to hit TV shows, continue to reflect how digital assets are increasingly finding their way into mainstream culture — a sign that broader public adoption might not be far off.

How close are we to full-scale Bitcoin adoption?

Back in 2022, Blockware, a firm specializing in Bitcoin mining technology, predicted that global BTC adoption would reach 10% by the end of the decade. Their outlook was based on how previous disruptive technologies — like cars, electricity, and the internet — spread over time.

Fast-forward to March 2025, and River, a Bitcoin-focused financial services provider, revealed that around 4% of the world’s population currently holds Bitcoin. Despite growing awareness, that still represents under 1% of Bitcoin’s total potential market.

River’s research also noted that Bitcoin adoption tends to be more prevalent in developed economies than in emerging ones.

Institutions are helping drive Bitcoin’s momentum

A key storyline in the current cycle is the growing involvement of institutions. Companies like Strategy and Metaplanet have pivoted to position themselves as Bitcoin-first treasury firms.

Other corporations are exploring BTC as a way to shield their reserves from inflation, reduce exposure to global instability, and prepare for the economic shifts brought on by de-globalization.

Meanwhile, the rise of Bitcoin investment products — like exchange-traded funds (ETFs) — is making it easier for both institutional and retail investors to gain exposure, without needing to manage the complexities of self-custody or blockchain transactions themselves.

For more news, find me on Twitter Giannis Andreou and subscribe to My channels Youtube and Rumble

What is your opinion on this particular topic? Leave us your comment below! We are always interested in your opinion!