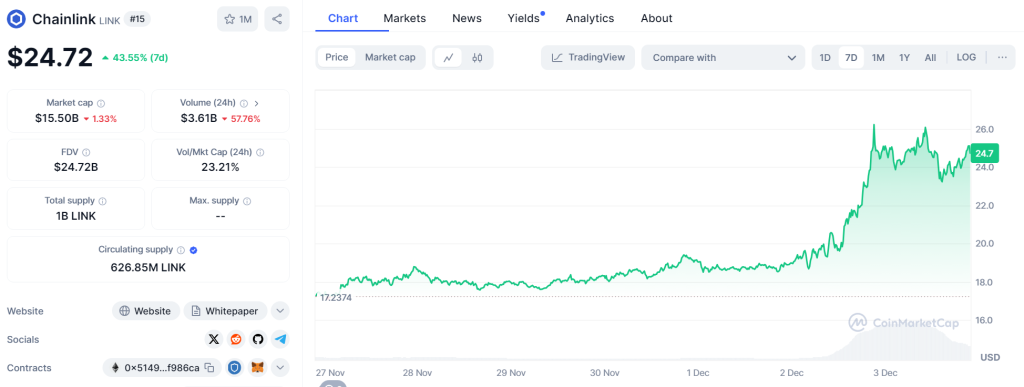

Chainlink’s (LINK) token has seen a remarkable surge, with a 27% price jump in just 24 hours on December 3, following a strategic partnership with Europe’s first EU-regulated tokenized securities market. This collaboration, with the European firm 21X, aims to launch a tokenized asset settlement system, pushing LINK’s price to a two-year high of $26.92, up 50% over the past week and 125% over the last month.

The partnership with 21X will see Chainlink provide its Cross-Chain Interoperability Protocol (CCIP), enabling 21X to settle assets across multiple blockchains. This system will integrate real-time market data and allow for seamless asset transfers, including tokenized stablecoins from multiple chains. Max Heinzle, CEO of 21X, emphasized that this collaboration will offer a secure and efficient platform for trading and settlement on a public permissionless blockchain, positioning Chainlink at the forefront of the tokenized asset space.

Chainlink network activity soars in parallel with the price surge. CryptoQuant data reveals a 286% rise in daily transactions, from 6,437 on November 29 to 24,901 on December 2. Active addresses increased by 179%, reflecting growing adoption and demand for LINK. This surge in network activity signals increasing interest in Chainlink’s ecosystem, reinforcing its strong market position.

Technical indicators show that while the relative strength index suggests LINK may be nearing an overbought condition, the appearance of a “golden cross” on the daily chart points to further bullish potential. The golden cross, which occurred on November 30, signals that the price could continue its upward trajectory. Traders are eyeing a price target of $30, with some even predicting LINK could surpass $50 in the coming year, driven by its growing adoption and partnerships.

In addition to these developments, Chainlink’s rally has been compared to XRP’s recent surge, with proponents positioning LINK as the true “bank coin.” Chainlink advocates, such as ChainLinkGod (Zach Rynes), argue that LINK is actively collaborating with major global financial institutions to connect banks to blockchains, setting it apart from XRP, which some view as a “banker-themed memecoin.” While XRP has seen its own gains, Chainlink’s focus on partnerships with traditional finance gives it a strong edge in bridging the gap between traditional banking systems and blockchain technology.

With growing interest and adoption, Chainlink continues to position itself as a leader in the tokenized securities market, reinforcing its role as a critical player in the future of decentralized finance.

For more news, find me on Twitter Giannis Andreou and subscribe to My channels Youtube and Rumble

What is your opinion on this particular topic? Leave us your comment below! We are always interested in your opinion!