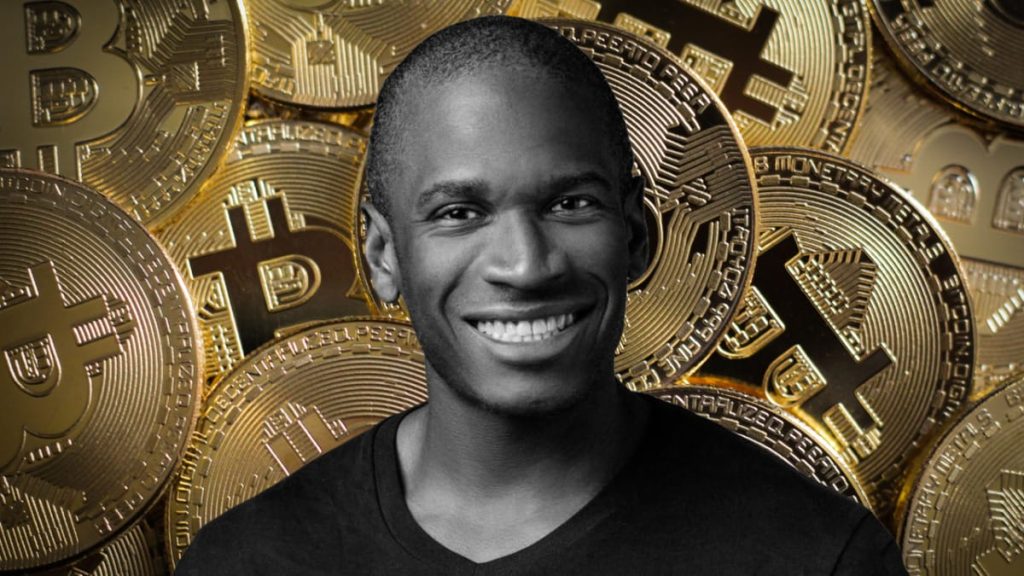

As anticipation builds around the possibility of the first rate cut by the U.S. Federal Reserve in four years, BitMEX co-founder Arthur Hayes has offered his views on how such a decision could impact the cryptocurrency market.

Speaking at Token2049 in Singapore on Sept. 18, Hayes delivered a keynote titled “Thoughts on Macroeconomics and Current Events.”

In his address, Hayes weighed the pros and cons of holding 5%-yielding Treasury Bills (T-bills) versus investing in cryptocurrencies, particularly in light of the potential market shifts that might result from the Fed’s expected rate cut, set to be announced on Sept. 18.

Fed is making a “colossal mistake”

Before diving into the potential effects on crypto markets, Hayes criticized the Federal Reserve for even considering cutting interest rates at this juncture, given the increasing U.S. dollar supply and government spending.

“I believe the Fed is making a colossal mistake by cutting rates at a time when the U.S. government is printing and spending at unprecedented levels during peacetime,” Hayes remarked. He went on to say:

“While many are eagerly anticipating a rate cut, hoping it will boost the stock market and other asset classes, I think the markets are going to crash a few days after the Fed makes its move.”

Hayes predicts that the likely cut — whether it ends up being 50 or 75 basis points — will trigger a market downturn by narrowing the interest rate gap between the U.S. dollar and the Japanese yen.

“We saw what happened recently when the yen dropped from 162 to about 142 in roughly 14 days, causing a near-financial meltdown,” he explained. “I think we’re on the verge of witnessing that kind of financial stress again.”

T-bills yields versus crypto returns: “We could reignite the Ethereum bull market”

Hayes also compared the income yields from various cryptocurrencies to T-bills, highlighting that many crypto assets are offering returns “either just above or below T-bill yields,” which can significantly influence their pricing.

“Why would anyone take the risk of investing in a DeFi platform when you could simply call your broker and invest in T-bills, earning 5.5% without the same risk?” Hayes questioned.

He reviewed the returns of several cryptocurrencies, including Ether, Ethena (ENA), Pendle (PENDLE), and Ondo (ONDO). Hayes disclosed that he holds significant positions in all of these tokens, except for ONDO, which he has yet to invest in.

Hayes noted that Ether has underperformed Bitcoin by a significant margin, describing ETH as an “internet bond” with a 4% yield — a figure that currently lags behind T-bills, but one he still invests in.

“If interest rates drop sharply, as I expect, then Ethereum starts to behave like money, and my returns increase,” he stated. Hayes concluded by saying:

“As rates decline rapidly, and I believe they will, following the Fed’s cuts and subsequent market collapse, we could see the Ethereum bull market reignite.”

For more news, find me on Twitter Giannis Andreou and subscribe to My channels Youtube and Rumble

What is your opinion on this particular topic? Leave us your comment below! We are always interested in your opinion!