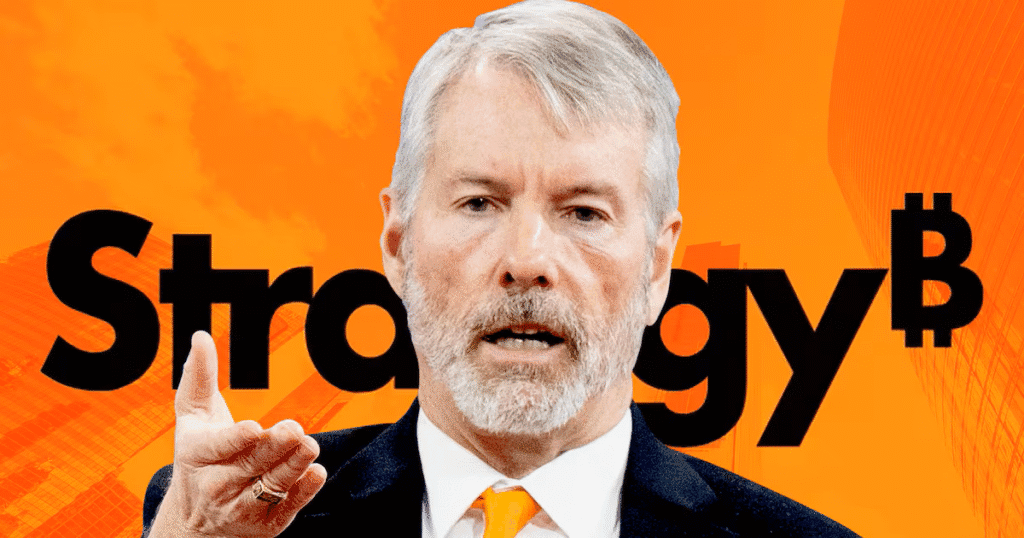

MicroStrategy co-founder and executive chairman Michael Saylor announced on Monday that his company recorded a remarkable $3.9 billion fair value gain on its Bitcoin holdings during the third quarter of 2025.

The news came just after Bitcoin (BTC) hit a fresh all-time high of $125,000 over the weekend, with exchange reserves dropping to their lowest level in six years. Unlike previous rallies, however, MicroStrategy will not be adding to its Bitcoin stack this week, Saylor confirmed.

Posting on X (Twitter), Saylor joked that instead of another purchase, the company was celebrating its performance:

“No new orange dots this week — just a $9 billion reminder of why we HODL.”

The “orange dots” refer to his chart marking MicroStrategy’s Bitcoin buys over time.

As of Sunday, the company holds 640,031 BTC, acquired at an average cost of under $74,000 per coin. At current market prices, that stash is valued at roughly $79 billion.

MicroStrategy’s record-breaking quarter

According to its SEC filing, MicroStrategy reported $3.89 billion in unrealized profit from its Bitcoin portfolio for Q3 2025, alongside a $1.12 billion deferred tax expense.

When factoring in an additional $5.8 billion in post-quarter gains, the company’s total unrealized profit climbs to over $9 billion — the same figure Saylor highlighted in his X post.

As of September 30, the firm’s digital assets carried a book value of $73.21 billion, with $7.43 billion in deferred tax liabilities. The figures underscore the massive appreciation of MicroStrategy’s Bitcoin investment as the asset surged past $125,000.

Saylor, long known as one of Bitcoin’s most vocal corporate advocates, has a history of buying BTC aggressively — often during price peaks. This week’s pause didn’t go unnoticed among crypto traders.

“Finally realized buying the top isn’t ideal? Waiting for the dip now?” one user quipped on X. Another commenter noted that “even Saylor deserves a breather.”

Despite the short-term pause, MicroStrategy’s Bitcoin holdings remain deeply in profit. Data from BitcoinTreasuries.NET shows the firm’s overall BTC position is up roughly 68%, reinforcing the strength of its long-term accumulation strategy.

Download the FREE Bitcoin Mining eBook

Kickstart your mining journey with essential insights:

https://bitmernmining.com/landing-page-ebook-download/

For more news, find me on Twitter Giannis Andreou and subscribe to My channels Youtube and Rumble

What is your opinion on this particular topic? Leave us your comment below! We are always intere