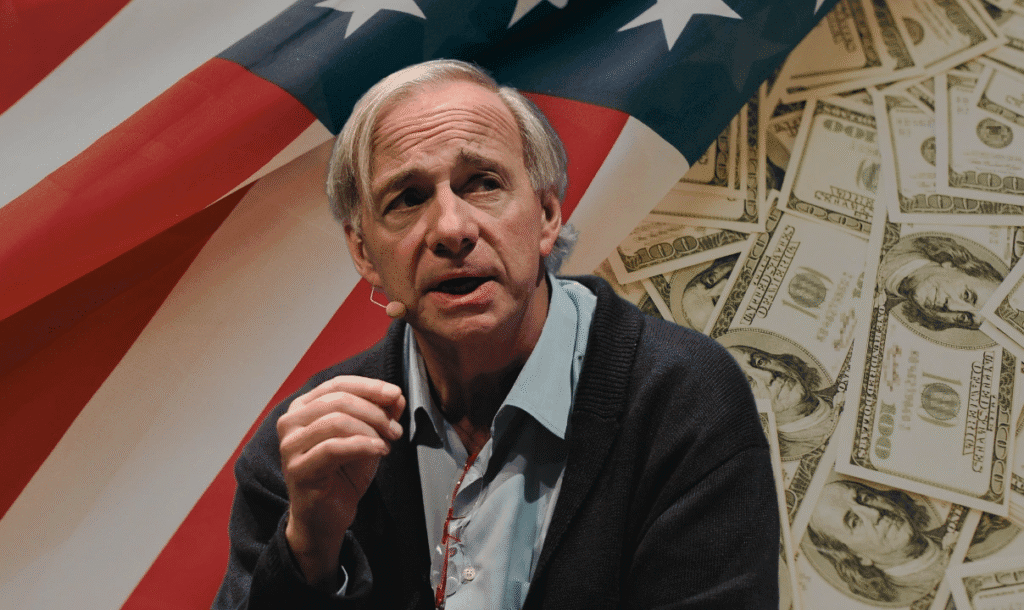

Renowned investor Ray Dalio has issued a stark warning that the current global monetary system is nearing a critical breakdown — a situation he says is being hastened by the trade policies of the Trump administration.

In a post shared on X (formerly Twitter) on April 28, Dalio, founder and ex-CEO of Bridgewater Associates, stated that rising trade tensions are accelerating deglobalization and deepening trade imbalances, which are fracturing the economic, political, and international frameworks that have governed the modern world.

He explained that these disruptions are creating long-lasting damage. Importers and exporters — especially those in the U.S. and China — are increasingly taking steps to reduce their reliance on each other and develop alternative strategies.

“They’re acknowledging that regardless of how tariffs evolve, these fundamental issues are here to stay. A significant decoupling from the U.S. is no longer theoretical — it’s something businesses now must prepare for,” Dalio wrote.

Dalio also questioned the long-term sustainability of the U.S. economy acting as both the world’s biggest buyer of manufactured goods and the largest issuer of debt. He warned that the expectation other nations will continue selling to the U.S. in exchange for U.S. dollars is becoming increasingly unrealistic.

This shift, he noted, could prompt countries to form new trade alliances and adopt different currencies for international transactions — moving away from the dollar-centric system.

Though Dalio didn’t name specific alternatives, he has previously backed “hard assets” like gold and Bitcoin during times of economic uncertainty.

Call for Cooperation Over Conflict

Dalio urged U.S. leaders to adopt a more collaborative and strategic approach, advocating for serious efforts to tackle the national debt and reduce economic vulnerabilities.

He argued that facing these structural issues head-on would yield far better outcomes than the current trajectory, which he described as riddled with conflict and instability.

“So far, the U.S. hasn’t chosen the wiser path,” he said. “Instead, we’re seeing troubling signs of infighting and volatility that could have permanent negative effects.”

He encouraged investors and decision-makers to look beyond short-term market fluctuations and focus on the profound structural shifts reshaping the global financial landscape.

China has felt the brunt of the Trump-era tariffs, including a 145% levy on all imports from the country. Canada and Mexico have also been targeted, facing 25% tariffs on the majority of their goods.

Meanwhile, key nations in the Bitcoin mining supply chain — including Thailand, Indonesia, and Malaysia — are facing respective duties of 36%, 32%, and 24%, which have already disrupted mining equipment imports into the U.S.

For more news, find me on Twitter Giannis Andreou and subscribe to My channels Youtube and Rumble

What is your opinion on this particular topic? Leave us your comment below! We are always interested in your opinion!