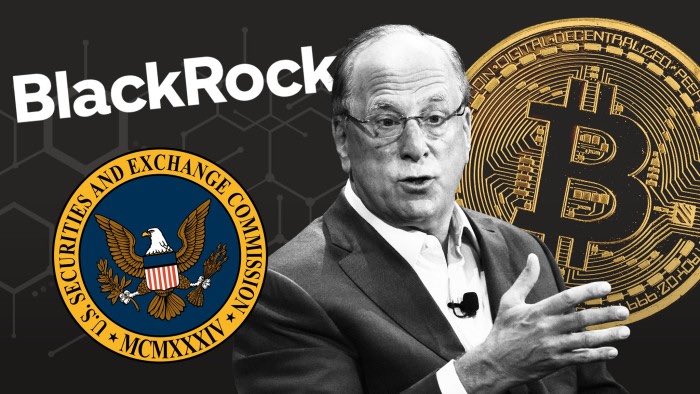

The U.S. Securities and Exchange Commission (SEC) has granted approval for Nasdaq to list and trade options tied to BlackRock’s spot Bitcoin ETF.

On September 20, the SEC issued a notice allowing options trading for the iShares Bitcoin Trust under the symbol IBIT on Nasdaq. The exchange confirmed that options trading for the Bitcoin ETF would operate under the same rules applied to other ETF options.

According to the SEC’s announcement, “Options on IBIT will be physically settled with American-style exercise.” The notice also highlighted that Nasdaq’s listing standards will apply, ensuring that the underlying asset meets requirements, such as having a large number of actively traded shares.

More approvals incoming?

It remains uncertain whether the SEC will extend similar approvals for other spot Bitcoin ETFs on U.S. exchanges. Bloomberg analyst Eric Balchunas suggested via X (formerly Twitter) that additional approvals could follow swiftly.

“This is just one part of the approval process. The OCC (Office of the Comptroller of the Currency) and CFTC (Commodity Futures Trading Commission) must also give their green light before trading can officially begin,” Balchunas noted. “Though there’s no fixed timeline for these approvals, this is still a significant move with the SEC coming on board.”

As of early August, IBIT’s trading volume surpassed $875 million, with all spot Bitcoin investment products collectively reaching over $1.3 billion. Additionally, Nasdaq has filed a request with the SEC to approve options trading for spot Ethereum ETFs.

For more news, find me on Twitter Giannis Andreou and subscribe to My channels Youtube and Rumble

What is your opinion on this particular topic? Leave us your comment below! We are always interested in your opinion!