The SEC had accused eToro of functioning as an unregistered broker and clearing agency due to its cryptocurrency trading operations.

To resolve these accusations, eToro will pay a $1.5 million fine as part of its agreement, which was disclosed by the SEC on September 12.

Under the terms of the settlement, eToro will limit its U.S. trading services to a small selection of cryptocurrencies and will stop breaching U.S. federal securities regulations.

From September 12, eToro’s American clients will be restricted to trading only Bitcoin, Bitcoin Cash, and Ether. They will also have up to 180 days to sell off other cryptocurrency holdings.

eToro has operated as a broker and clearing agency since at least 2020: SEC

This isn’t eToro’s first brush with regulatory issues; earlier this year, the Philippines SEC charged eToro with offering unregistered securities.

According to the SEC, eToro has been acting as both a broker and clearing agency in the U.S. since 2020 without the proper registrations, engaging in activities considered securities offerings by the SEC.

The $1.5 million settlement reflects eToro’s commitment to halt violations of federal securities laws, says Gurbir Grewal, the director of the SEC’s division of enforcement:

“eToro’s decision to remove tokens deemed investment contracts from its platform signals their move toward compliance within our regulatory framework. This resolution not only protects investors but also paves the way for other crypto entities to align with legal standards.”

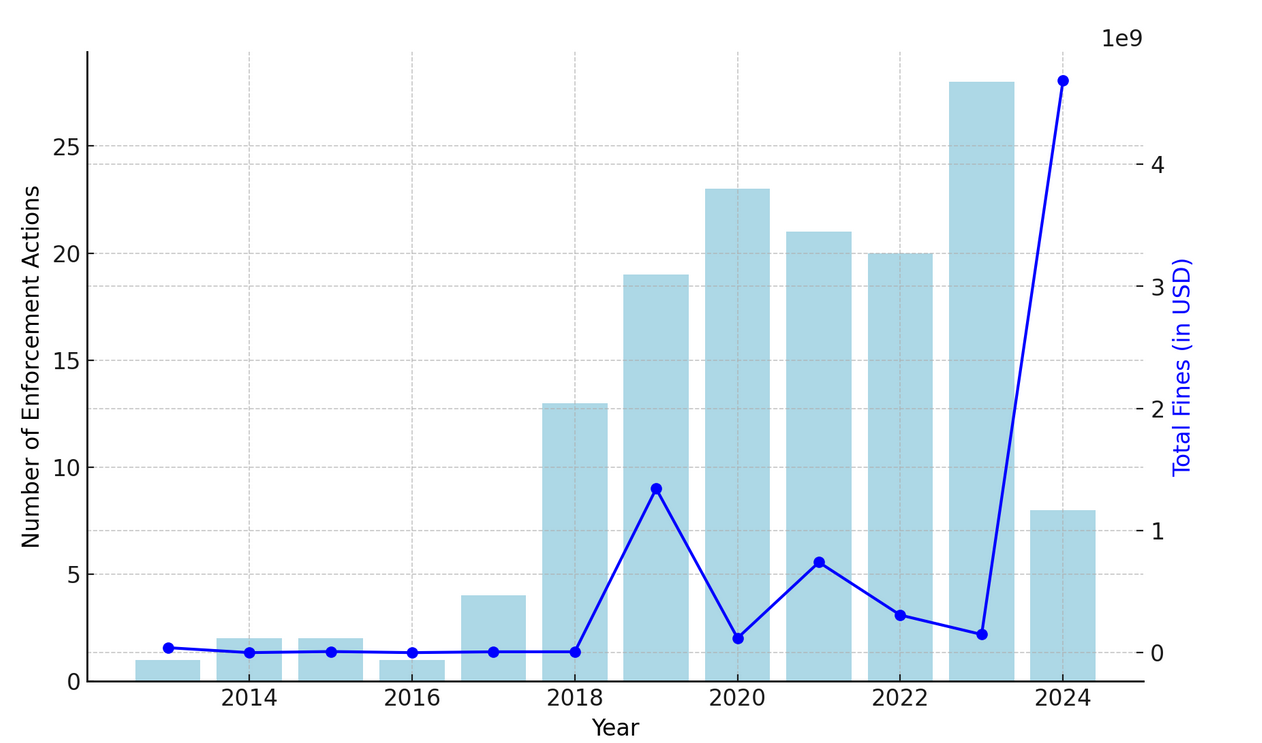

SEC crypto enforcement up over 3,000% since 2023

2024 has been a landmark year for the SEC’s crypto enforcement, highlighted by the record-setting $4.47 billion settlement with Terraform Labs and its former CEO, Do Kwon, in June. This action alone was the SEC’s “largest enforcement action to date,” as noted in a report from Social Capital Markets on September 9.

Before the eToro settlement, the SEC had already imposed nearly $4.7 billion in fines against various crypto firms and executives this year, marking a staggering increase of over 3,000% from the $150.3 million in fines in 2023. This year, the SEC has focused on fewer but more significant cases, indicating a strategic shift in its enforcement approach.

For more news, find me on Twitter Giannis Andreou and subscribe to My channels Youtube and Rumble

What is your opinion on this particular topic? Leave us your comment below! We are always interested in your opinion!