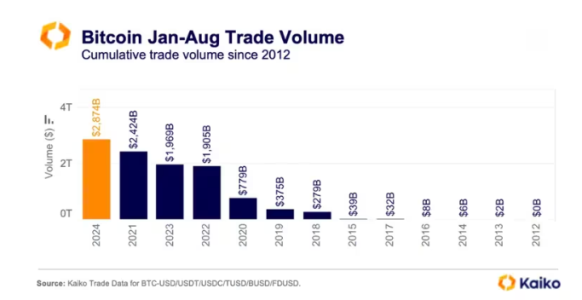

Bitcoin has seen a remarkable surge in trading volume in 2024, outstripping the highs of the 2021 bull market by 20%. This growth, recorded at $2.874 trillion on centralized exchanges in just the first eight months of the year, eclipses the $2.424 trillion from 2021, marking a historic achievement for Bitcoin’s market dynamics.

Factors Driving the Trading Volume Surge

Key drivers of the 2024 surge include enhanced adoption of spot Bitcoin ETFs and increased market volatility. Bitcoin hit a peak of $70,000 in April, buoyed by significant investments into spot Bitcoin ETFs by institutional players seeking exposure to the cryptocurrency. Moreover, anticipations of U.S. Federal Reserve rate reductions have bolstered the crypto market’s bullish outlook, ramping up trading volumes. The volatility, peaking at an annualized rate of 100% in April, has been pivotal, offering traders opportunities to capitalize on price movements, especially during fluctuating market conditions resurfacing in August amid U.S. economic uncertainties and changes in the yen carry trade.

Bitcoin’s Record-Breaking Year

The total trading volume of $2.874 trillion for 2024 has set a new record for Bitcoin on centralized exchanges, highlighting the maturing market and escalating involvement from both retail and institutional investors. The data from Kaiko reveals a robust demand for Bitcoin, sustained despite its price volatility, enhancing its position as a fundamental asset in the global financial markets.

Bitcoin’s Volatility and Market Sentiment in 2024

The significant volatility experienced in 2024 underscores the ongoing excitement and unpredictability surrounding Bitcoin, with the cryptocurrency nearing its all-time high price of $70,000 in April. Traders have leveraged these volatile conditions for profit, attracting new participants eager for short-term gains. However, volatility re-emerged in August, stirred by U.S. economic worries and the unwinding of the yen carry trade, affecting financial market stability and prompting active trading in Bitcoin.

The Future of Bitcoin Trading in 2024

Looking ahead, the remainder of 2024 poses questions about the sustainability of Bitcoin’s trading momentum. With trading volumes already surpassing 2021 figures, the cryptocurrency is expected to have a substantial impact on global financial markets moving forward. The adoption of spot Bitcoin ETFs and macroeconomic factors such as U.S. Federal Reserve decisions and global market instability will likely continue to influence Bitcoin’s trading dynamics.

Conclusion: Bitcoin Trading Volume in 2024 Surpasses 2021 by 20%

In conclusion, Bitcoin’s trading volume has soared to $2.874 trillion in 2024, a 20% increase over the 2021 bull market, driven by significant market volatility, substantial inflows into spot Bitcoin ETFs, and increasing institutional interest. This growth underscores Bitcoin’s expanding role as a primary asset in the global financial landscape.

For more news, find me on Twitter Giannis Andreou and subscribe to My channels Youtube and Rumble

What is your opinion on this particular topic? Leave us your comment below! We are always interested in your opinion!